Preserving Communities and Legacies

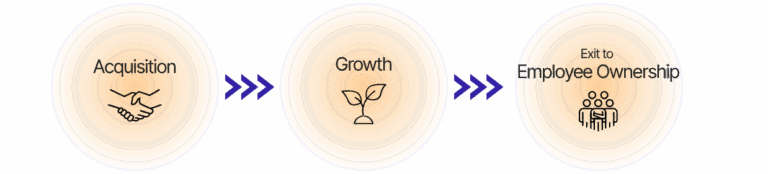

Our 3-Step Model

Our mission is simple: preserve and strengthen community businesses using Entrepreneurship Through Acquisition (ETA). We start by purchasing a business, lead the business through a period of sustainable growth, and finally convert the business to a form of employee ownership.

We currently operate like a search fund—actively searching for one business to acquire and operate. Unlike venture capital firms, we aren’t seeking 10x or 100x growth projections. Instead, we are looking for businesses that we can grow organically with the future in mind, building on existing trust with customers, communities, and employees.

Private equity usually exits by selling to the highest bidder. We exit by selling to employees. Following the growth period, we will begin an exit process that transitions ownership to the company’s most important asset: its people. An employee-owned end state is the ultimate way to preserve a seller’s legacy.

Why Employee Ownership?

Employee ownership is a triple win: it improves business performance, builds employee wealth, and ties businesses inextricably to their communities.

For Businesses

By aligning the incentives of employees and the company as a whole, employee ownership motivates all employees to improve the company. Think about it—would you be more likely to share a great idea or put in an extra hour if you had a share in the company’s profits? Data supports this logical conclusion: a Rutgers University meta-analysis of over 100 studies found that employee-owned firms consistently outperform others in firm survival and productivity. In the US, employee-owned businesses are 20% more likely to survive over a 12-year period than their traditional peers.1

For Employees

The vast majority of American workers—82%—do not have the financial means to acquire ownership stakes in the companies where they work.2 When you barely make enough to pay for necessities every month, it’s nearly impossible to build wealth, no matter how hard you work. Employee ownership is a powerful way to address this problem, as it allows employees to earn equity in their companies without needing capital to buy in. According to the Ownership Capital Lab, “Frontline workers… have earned in the range of $10,000 to 20,000 in their first years of being employee owners.”3 That is life-changing money for an employee living paycheck to paycheck. Over time, employee ownership can create generational wealth where it was previously impossible. On average, employee-owners have a household net worth nearly twice as high as their peers in similar non-EO companies.4 Employee owners also have a 53% longer median job tenure, providing the security necessary to create a fulfilling life.5

For Communities

40% of US corporate equity is owned by foreign investors, and much of the rest is owned by investors disconnected to the communities where small businesses operate.6 When businesses are owned by employees, the wealth they create instead flows back to the communities where those employees live. Locally owned businesses circulate three times more money back to their communities than chains or absentee-owned firms.7 Beyond preventing firm closures, employee ownership has been linked to a number of surprising benefits for communities. These include better health outcomes, increased volunteerism, and even higher voting rates for both Republicans and Democrats.8 In today’s divided age, employee ownership is one of the few issues that still draws bipartisan support, as it brings communities together and helps them thrive.

Sources

1 Douglas Kruse, IZA World of Labor, 2016: “Does employee ownership improve performance?”

2, 3, 4 Katherine Katcher & Alison Lingane, Ownership Capital Lab, 2025: “The Silver Tsunami, the Great Wealth Transfer and the future of employee ownership in the United States”

5, 7 Project Equity: “Small business closure crisis”

6 Steven M. Rosenthal & Theo Burke, Tax Policy Center, 2020: “Who Owns US Stock? Foreigners and Rich Americans.”

8 Project Equity, 2020: “The Case for Employee Ownership”